Through the 2020 Presidential Race, the topic of student loan forgiveness was on several ballots. Bernie Sanders and Elizabeth Warren both touted the policy’s merits, while many deprecated the idea as expensive and inefficient.

To date, roughly 45 million Americans carry $1.6 trillion in total student loan debt. Among household debt categories, this expense surpasses all but mortgages.

As Sanders and Warren dropped out of the presidential race, pundits of the political right breathed a sigh of relief, only to have their anxiety return with the impending election of Joe Biden.

At Road Work Ahead, we typically do our best to eschew politics, but economic policy is unfortunately married to the distasteful and vitriol-inducing topic. Even so, I’ll do my best to present the hard economic facts and show arguments from both sides for the complete picture.

Wish me luck.

The Why

Why cancel student debt?

Several reasons for:

As a means of federal stimulus, especially in light of Coronavirus

The reduction of racial wealth gaps

To stimulate local economies. Less debt implies greater discretionary spending.

To help young professionals “start their lives” sooner (aka get married, buy houses, have kids, etc.)

Several reasons against:

Student debt cancellation is regressive, and not stimulative

It disproportionately targets the wealthy upper and middle classes, who likely have the resources to pay off their debts

Potentially harmful tax repercussions, as forgiven debt is regarded as taxable income

Loss of revenue for the federal government

Cancelling student debt doesn’t address the high cost of education

The Graphs

A full understanding of this situation is aided by our old friend, graphs.

The following graph shows the distribution of student loan debt, based on the amount of college attended and unemployment status.

Those who have pursued higher education understandably racked up the highest amount of debt, but also have the greatest earning potential. An argument could be made that cancelling student debt for this demographic would only serve to widen the wealth gap.

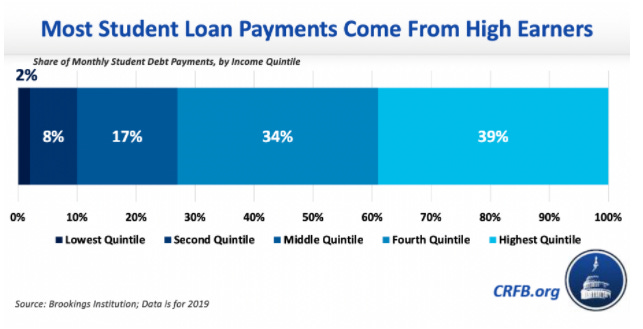

The next graph looks at the share of student loan payments, broken down by income quintile.

I sourced this graph from an article decrying the merits of student loan forgiveness, but I’m not so sure it helps their argument.

While the fourth and highest quintiles bear the overwhelming brunt of student debt payments, this is likely a factor of ability. High earners have the ability to pay their debts, while the lowest earners do not.

In 2019, the median income across the United States was $47,500. A report by the US Census found that 44% of adults with earnings below the median had no education beyond highschool, which is indicative of a correlation between education level and income potential.

Bearing that in mind, look at the graph below.

Students from homes with less education, and therefore likely less income, are highly likely to default on the payment of their student loans.

Not to mention, many of the students in low income areas and families will likely never have the opportunity to receive a quality education, will subsequently likely never attain a degree, and because of American meritocracy, never make it out of this vicious cycle.

That’s a whole other can of worms.

To the point, forgiving student debt would alleviate immediate pressure on a demographic with shockingly high default rates, but will not solve the greater systemic issues at play.

If one generation’s student debt is forgiven, perhaps they can get ahead, acquire the typical trappings of the “American Dream”, but then what? Does the next generation face the same fate?

The Racial Divide

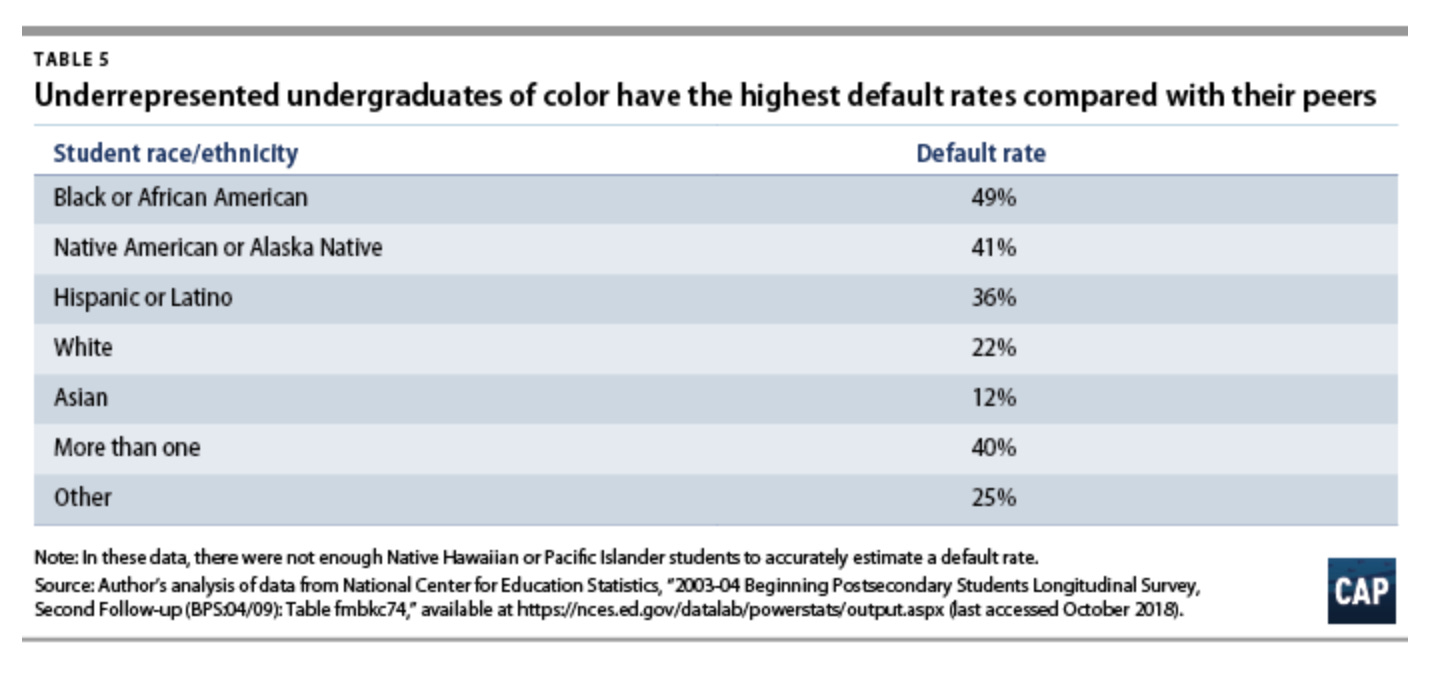

Another pertinent talking point of this debate is the racial divide, and its exacerbation by student debt.

A report by Brookings found that upon earning a bachelor’s degree, black graduates owe $7,400 more on average than their white peers.

Over the next few years, the gap widens. Differences in interest accrual and graduate school borrowing lead to an average $53,000 of student debt for black graduates four years after graduation. This is nearly double their white counterparts.

As expected, default rates follow suit.

People of color are at least twice as likely to default on student loans as their white peers.

Again, forgiving student debt temporarily massages the greater issue at hand. People of color will be able to build wealth more easily with student debt forgiven, but what happens to the next generation?

It’s like slapping a bandaid on a gunshot to the chest.

There is something to be said for the case in which non-white demographics are able to build generational wealth as a result of student debt cancellation. If the next generation is able to tap into that wealth to assuage their debt burden, that’s a step in the right direction for bridging the wealth gap.

Unfortunately, I think that’s too little, and too slow. With default rates at 49% for the African American demographic, it will take much more than a one-off fiscal policy to right the situation.

What frustrates me is the prospect of the primary motivation behind student debt forgiveness being economic stimulus. I understand the pandemic changes the tenor around the need for stimulus, but perhaps sustained economic growth and strength would be best achieved by creating equal opportunity and quality of life across all people groups in America.

How Student Debt is Forgiven

As of May, there were several different plans for how to approach student debt forgiveness.

The Senate Plan: Democratic senators have been pushing for universal student loan forgiveness - here’s what it would include.

The government pays up to $10,000 in regular student loan payments on behalf of borrowers.

Only direct federal student loans are eligible. Private loans are exempt.

The $10,000 payment would not be treated as taxable income to the borrower.

The House Plan: Sponsored by several House Democrats, this plan extends further.

$30,000 in federal student loans would be forgiven.

Private student loans are once again exempt.

The $30,000 payment is also not treated as taxable income to the borrower.

Any loan balances left over after the $30,000 payment would be assumed by the government through the duration of the pandemic.

The Biden Plan: President-Elect Biden’s plan has changed slightly since May. His current plan is detailed below.

Forgive up to $10,000 of student debt for certain borrowers, excluding graduate program borrowers and private student loans.

Eligibility limited to borrowers from public colleges and universities, historically black colleges and universities, and private minority-serving institutions.

Eligibility would further be limited to borrowers who earn an income of less than $125,000 per year.

Of the presented plans, Biden’s is the most conservative. That being said, each plan entails massive government spending through direct payments to borrowers, or on behalf of borrowers. Yep, more money printing.

Hold onto your butts. The inflation train cometh.

Sanders and Warren had planned to pay for their respective forgiveness plans through tax programs. Warren proposed a broad tax across the wealthy (which has certainly been effective in the past, wink wink nudge nudge) and Sanders planned a Wall Street tax on stock, bond, and derivative trades.

Biden plans to raise taxes on households earning more than $400,000 per year, which may be put towards student loan forgiveness.

It won’t be pretty, however. Wealthy Americans will decry the taxes as taking their money to pay for the school of those who didn’t earn it. If anything, this will push the wealthy to incorporate overseas and in income tax-friendly areas at a higher rate, only exacerbating the problem and widening the wealth gap.

Student Debt Forgiveness as Stimulus

According to a study conducted by the Committee for a Responsible Federal Budget, cancelling student debt is poor economic stimulus.

By several economists estimates, cancelling $1.5 trillion of student debt would have an economic multiplier value of roughly 0.23 times. This means that for each dollar of student debt cancelled, 23 cents is generated.

Running the numbers further, this equates to a near-term lift of the economy totaling $360 billion, but at a cost of $1.5 trillion.

Yikes.

Compared to other stimulus strategies already enacted through the recession, student debt forgiveness doesn’t stack up.

Student debt forgiveness also has latency. This form of stimulus doesn’t put money into people’s pockets right away, as forgiveness payments would be made over the duration of the loans, which could be up to 30 years.

Over the course of a 20-30 year loan, it’s estimated that student loan forgiveness would put $200 to $300 back into borrower’s hands per month. This is certainly helpful for income-strapped families in the lowest earning brackets, but again, these aren’t the households that comprise the vast majority of student debt.

In Conclusion

There are mixed benefits to student debt forgiveness, but almost exclusively in the short term.

Pressure can be removed from the lowest-earning households and recent college graduates, but these policies are not broadly corrective.

A targeted student loan forgiveness plan, such as the Biden administration’s plan, will be more efficient than removing student debt from those with high income power and potential.

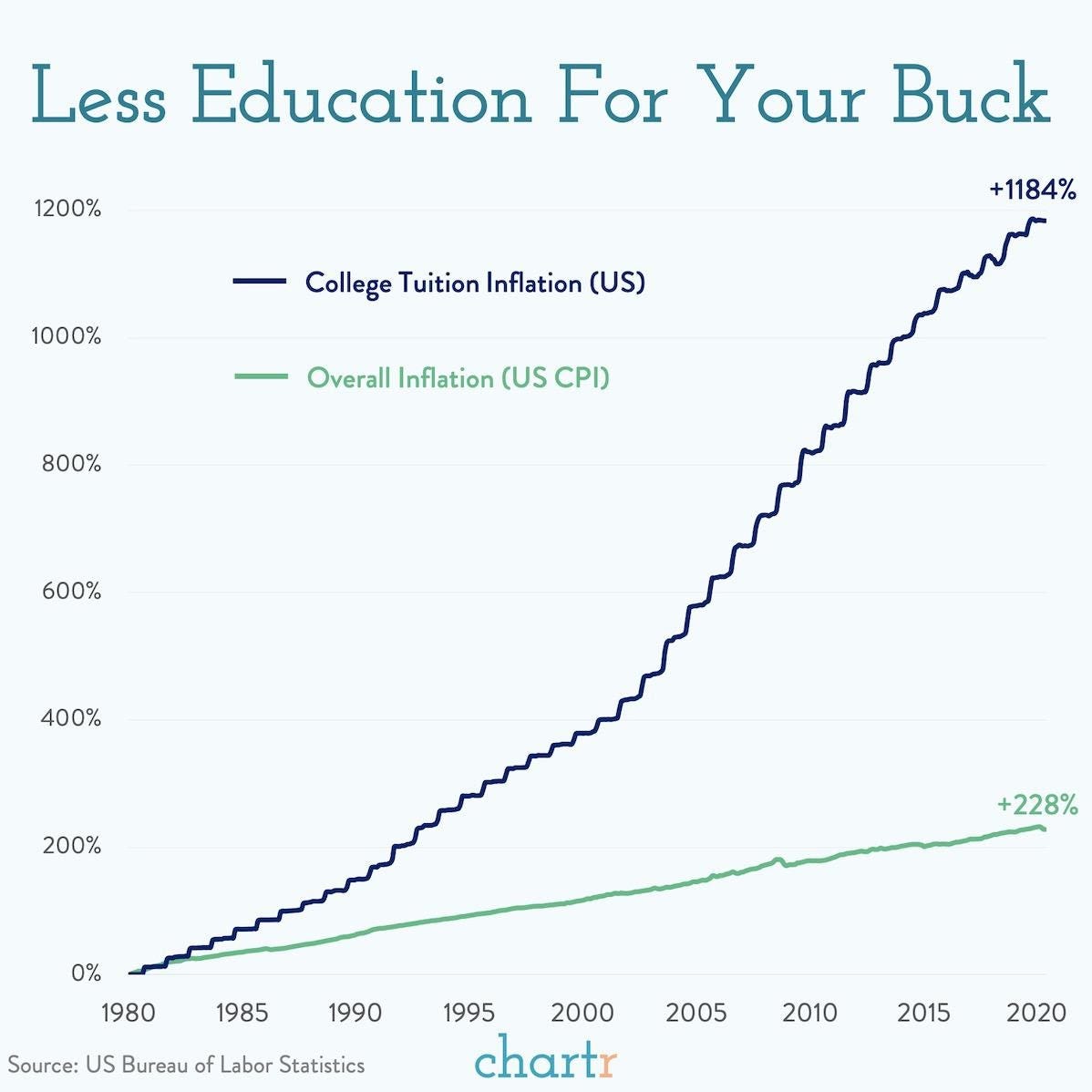

All that aside, there are bigger fish to fry. A look into the wildly rising cost of tuition is revealing.

The U.S. CPI, or Consumer Price Index, tracks the rise of inflation. College tuition has increased at nearly double the rate of inflation, and this graph only shows data through June of 2017.

Forgiving student debt once does not solve this issue. The next graph is worse.

I’m no policy expert, but something needs to be done to make education less of a money-sucking business. Long term effort needs to be directed at education institutions to stop the incorrigible rise of tuition and make the system sustainable.

Perhaps $1.5 trillion could be put towards fixing the behemoth that is higher education rather than kicking the can down the road.

That’s all for this week! Apologies for the meandering and gargantuan length of this article.

If you found this interesting of helpful, please share with a friend using the button below!